Transform Your Viewing Experience with Epson 680 Projector: A Comprehensive Review

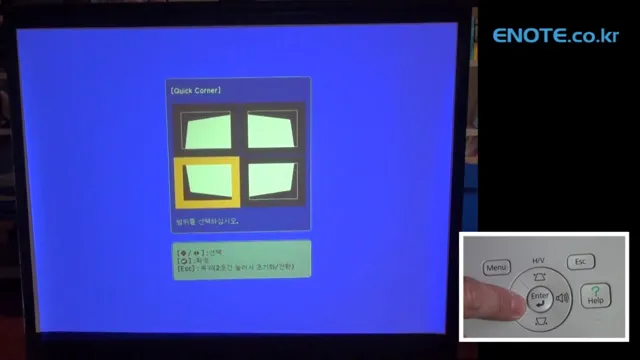

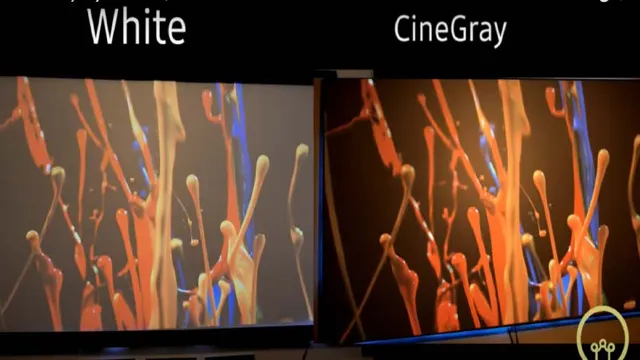

Looking for a projector that delivers high-quality images, but don’t want to break the bank? Look no further than the Epson 680 projector! This affordable option offers stunning picture quality, with crisp, clear images that pop off the screen. Whether you’re watching movies, playing video games, or giving a presentation, the Epson 680 projector is … Read more